Imagine your E-commerce store is flourishing, with customers making purchases left and right. However, the payment gateway you’ve chosen isn’t up to par, causing frustration for both you and your customers.

In fact, according to a recent study by Baymard Institute, 18% of US adults have abandoned an online purchase due to concerns about payment security, and 9% of US adults abandoned checkout because there were not enough payment options.

As an ecommerce business owner using Magento 2 as your platform, it’s crucial to choose a reliable payment gateway that ensures seamless transactions while also providing top-notch security measures.

With so many options available in the market today, it can be overwhelming to sift through them all. But fear not! We’ve done the research for you and compiled our list of top payment gateways that offer unparalleled security and user-friendly operations for Magento 2.

So let’s dive in and explore these outstanding solutions together!

Understanding Payment Methods, Gateways, And Payment Processors For Magento Stores

Payment methods and gateways are essential components of running a successful e-commerce business, as they facilitate secure and efficient transactions between customers and merchants.

To accept electronic payments on a Magento store, it’s vital to understand what payment gateways are, their options, and how they work in the platform.

What is a Payment Method?

In simple terms, a payment method is a way in which buyers choose to pay for their purchases—through credit or debit cards, digital wallets like Apple Pay or Google Pay, bank transfers, local payment options such as iDEAL (for the Netherlands), and many others.

What is a payment gateway?

An ecommerce payment gateway simply means a merchant service that allows card payment through the existing online shop software. The system facilitates direct payments between the customer and the merchant via e-commerce businesses or online shopping sites.

Payment Gateway allows customers the convenience of providing secure data for credit cards. It is possible to transfer these funds to a transaction portal of a merchant or an acquiring bank.

What is a Payment Processor?

Payment processing companies are financial institutions that operate in the background, providing payment processing services to Internet merchants to ensure the security of transactions.

Payment processors connect a bank to a user. It handles requests for the payment gateway to validate and executes the information on transactions, takes money from the client, and sends it to the merchant’s account. During that process, it informs the payment gateway about its success.

How Does A Magento Payment Gateway Work?

A Magento payment gateway serves as an intermediary between the customer’s bank, the merchant’s account, and the e-commerce store itself. It provides a secure way for users to pay with their credit or debit cards without sharing sensitive information directly with the vendor. This essential component of e-commerce helps streamline online transactions and minimize the risk of fraud.

Step-by-Step Process of a Magento Payment Gateway

- Customer places an order: When customers decide to make a purchase, they proceed to the checkout page and enter their card details.

- Encryption of card details: The Magento payment gateway ensures that the customer’s card details are securely encrypted before being transmitted. This encryption protects sensitive data from potential security threats or hackers.

- Verification and authorization: The encrypted card details are sent to the payment service provider (PSP), which forwards them to either the issuing bank or credit card network for authorization.

- Confirmation and approval: If the issuing bank or credit card network approves the transaction, a confirmation message is sent back to the PSP. This process verifies the customer’s account has sufficient funds and that the card is valid for the transaction.

- Funds reservation: Once approved, the funds will be reserved in the customer’s bank account and transferred to the merchant’s account at a later time. This step ensures that the merchant receives payment before shipping the product or providing the service.

- Completion of the transaction: After the funds have been reserved, the Magento payment gateway sends a confirmation message to the e-commerce store. The store then updates the order status, and the customer receives a confirmation email or notification.

- Settlement and transfer: Finally, the funds are transferred from the customer’s bank account into the merchant account, completing the transaction.

Factors To Consider When Choosing A Magento Payment Gateway

When selecting a Magento payment gateway, consider factors such as security and encryption, compatibility with your Magento version, transaction fees and pricing, supported payment methods, integration ease, and user experience.

Security And Encryption

Security and encryption are among the most crucial considerations when choosing a Magento payment gateway.

Online transactions involve sensitive data like credit card details, passwords, payment details, and bank account information. Encryption provides additional security by scrambling customer data during transmission or storage so that third parties cannot intercept it.

To ensure payment gateways provide extra layers of protection:

- Look for payment processors that meet industry standards, such as PCI compliance, which ensures secure transmission of customer data.

- Choose a provider with robust fraud protection measures such as 3D Secure authentication or CAPTCHA systems to guard against fraudulent activities.

- Use SSL/TLS (Secure Socket Layer/Transport Layer Security) as it secures communications between customers’ browsers and web servers.

Some payment gateway providers also offer tokenization services where credit card numbers get replaced with random codes called tokens during processing to minimize the possibility of theft or hacking attempts on your website’s database.

Don’t compromise on security when it comes to accepting payments online – choose one of the top payment gateways for Magento 2!

Read Essential Magento Security Tips and Practices

Compatibility With Your Magento Version

Selecting a payment gateway that is compatible with your specific Magento version is crucial for your Magento 2 store. Incompatible payment gateways can lead to technical glitches or payment processing issues. Ensuring compatibility between your chosen payment gateway and your Magento version can lead to the following:

- Smooth transaction processing

- Improved customer satisfaction

- Reduced errors in the checkout process

Evaluate payment gateway compatibility

Consider the following factors when evaluating payment gateway compatibility:

- Integration options with different Magento versions

- Potential issues with older Magento versions

- Support for multiple currencies and languages

Examples of Payment Gateway Compatibility

PayPal: Renowned for its user-friendly and flexible payment options, PayPal may have some compatibility issues with older versions of Magento.

Stripe: This provider offers extensive integration options, supports multiple currencies and languages, and is fully compatible with the most recent Magento versions.

Verify Compatibility Requirements

Before committing to a payment gateway, review their documentation or contact their support team to confirm their compatibility with your Magento version.

By prioritizing compatibility, you can guarantee a seamless shopping experience for your customers and maintain efficient operations for your Magento 2 store.

Transaction Fees And Pricing

A payment gateway should meet your needs without breaking the bank. Here are some tips to optimize your payment options:

Compare transaction fee structures to maximize profitability

Transaction fees are an inevitable expense that can accumulate quickly, particularly if you have a high volume of sales. To make an informed decision, compare transaction fees across providers and examine their fee schedules to uncover any hidden setup or maintenance costs.

Consider discounts and incentives to offset costs

Some providers may offer discounts or incentives for using their service, which can help offset the costs associated with using their gateway. Keep an eye out for such offers, as they can make a difference in your overall expenses.

Evaluate pricing plans and their implications on your bottom line

The pricing plans for Magento payment gateways can vary significantly depending on the provider. Some factors to consider are the following:

- Monthly fees, in addition to per-transaction fees and daily batch fees

- Fixed rates for specific transaction amounts or a percentage of each sale

Choose a gateway that Balances Budget and Business Needs

To find a Magento payment gateway that aligns with your budget and business requirements, carefully weigh the security, features, and functionality of different options against their associated costs for a user-friendly experience.

Supported Payment Methods

When selecting a Magento payment gateway, it’s crucial to consider the supported payment methods. Offering a wide range of options increases the likelihood that customers can use their preferred method, improving their shopping experience.

Ensure the Magento payment gateway you select supports all relevant regional and international payment methods your customers expect when shopping online with you. This includes:

- Catering to regional preferences

- Supporting popular international payment methods

- Regularly updating supported payment options

Popular Payment Methods

Some popular payment methods to look for in a payment gateway include:

- Debit cards and Credit card payments

- Bank transfers

- Alternative online payment solutions (e.g., Apple Pay or Google Pay)

The Importance of Local Payment Methods

Don’t overlook local payment methods, as they can be vital for targeting specific markets. For instance, offering SEPA Direct Debit for an eCommerce business in Europe can significantly increase conversion rates.

By offering a diverse range of supported payment methods, you can enhance the customer experience and ensure your Magento store caters to a global audience effectively.

Integration

Choosing the right Magento payment gateway for your business requires a focus on seamless integration. Integration refers to how smoothly the payment gateway can be integrated into your e-commerce website.

Navigate the Integration Process

Integrating your chosen payment gateway can bring many benefits to your Magento 2 store, including increased conversion rates and improved customer experience. However, you may encounter common challenges during the integration process, such as:

- Compatibility issues with other extensions or modules

- Technical difficulties in setting up API credentials

- Ensuring proper security measures are in place

With preparation and guidance from your payment gateway provider, you can overcome these challenges smoothly and ensure a seamless integration that benefits your business.

Customer Experience

Incorporating features such as guest checkout options or a simplified checkout process can improve customer satisfaction and increase conversion rates. Choose a payment gateway that provides an efficient and hassle-free purchasing experience for your customers.

For example, PayPal’s integration with Magento is straightforward, allowing users to pay easily without leaving the website, resulting in a smooth transaction process. Stripe has also gained popularity due to its flexibility and simplicity of integration into different websites.

How To Integrate Payment Method In Magento 2?

Payment gateway integration in Magento 2 provides a seamless and secure checkout process for customers. By integrating a Magento payment gateway, you can enhance customer satisfaction while maintaining secure online transactions that drive sales growth in today’s competitive market environment.

MAGENTO PAYMENT GATEWAY INTEGRATION PROCESS

To successfully integrate a payment gateway, follow these steps:

1. Choose the Right Payment Gateway

Select a payment gateway that meets your business needs, considering factors such as transaction fees, supported payment methods, and compatibility with your Magento version.

2. Obtain the Necessary Credentials

Sign up for a merchant account with the chosen payment provider and obtain API keys or other necessary credentials to enable integration.

3. Install a Compatible Extension

Some payment gateways require specific extensions for proper integration. Search for an appropriate extension on the Magento Marketplace and install it.

4. Configure Payment Method Settings

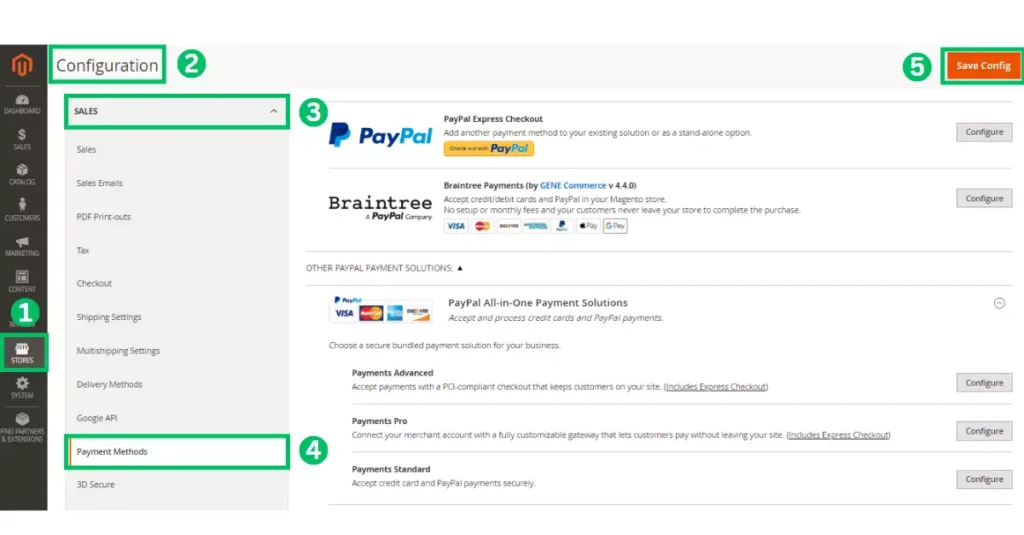

For payment method configuration, navigate to your Magento admin panel:

- Go to Stores > Configuration > Sales > Payment Methods

- Select the newly installed payment method (or configure a recommended solution)

- Enter your API credentials or other required information.

5. Customize Checkout Options

Enable features such as guest checkout or 3D Secure authentication based on your preferences within the settings of the chosen payment method.

6. Test the Integration

Perform test transactions using sandbox mode (if available) or by making real purchases with small amounts to ensure correct payment processing and secure customer data transmission.

7. Enable Live Transactions

Switch from sandbox mode to live mode once satisfied with testing results to begin accepting online payments from customers using your integrated payment solution.

8. Monitor Performance Regularly

Track transaction success rates, chargebacks, refunds, and customer feedback to make any necessary adjustments or improvements over time.

Top 7 Best Magento Payment Gateways

Here are the top 7 best Magento payment gateway options that provide secure and user-friendly transactions: PayPal, Stripe, Braintree, Authorize.Net, CyberSource, Square, and Amazon Pay.

PayPal

As one of the most popular payment gateway solutions among customers and online store owners, PayPal boasts more than 218 million consumer accounts and is used by over 17 million merchants worldwide. PayPal offers a comprehensive range of features, benefits, and extensive reach that makes it a strong choice for Magento 2 payment gateway integration.

Features

PayPal offers an array of features that make it an attractive choice for Magento 2 stores:

- Support for multiple payment methods: PayPal Payments Pro, the business version of the payment gateway provider, accepts payments from American Express, Visa, Mastercard, Venmo, and PayPal Credit in 26 leading currencies.

- Global reach: PayPal is available in over 200 markets, ensuring a broad reach for your business.

- Recurring Payments: Support subscription-based service payments with automated or scheduled recurring charges.

- Security Measures: Compliance with PCI DSS (Payment Card Industry Data Security Standard), 3D secure authentication protocols, SSL encryption, and fraud protection tools to ensure the safety of your customers’ data and transaction details.

- Easy Integration: Seamless integration with the Magento platform through dedicated modules or API access for smooth payment processing on your online store.

- Customization Options: Availability of customizable checkout forms or hosted payment pages to match your brand’s look and feel while providing a consistent user experience across all devices.

- Reporting & Analytics: Access to detailed transaction reports and analytics tools to help monitor your business performance, track losses due to chargebacks or disputes, optimize your pricing strategy and improve overall operations.

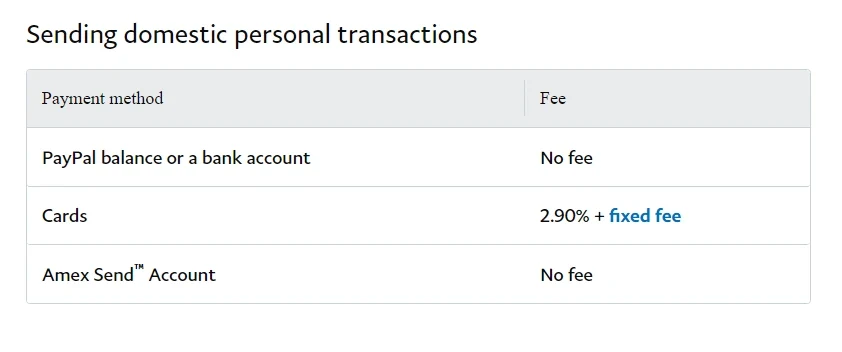

Costs

- Gateway subscription: The subscription fee for PayPal Payments Pro is $30 per month.

- Transaction fees: For domestic transactions, fees are 2.90% + a fixed fee depending on the currency ($0.30 for the US or €0.35 for Europe). For international commercial transactions, an additional percentage-based fee of 1.5% applies.

Integration with Magento 2

Integrating PayPal into your Magento 2 store is straightforward and available out of the box. To set up PayPal in your Magento checkout, follow these steps:

- Log in to your Magento Admin panel and navigate to Stores.

- Click Configuration > Sales > Payment methods.

- Configure your PayPal Checkout and fill in the required details (like PayPal Merchant Account, API Signature/username/password, etc.)

For a complete guide to Magento PayPal integration, refer to the official website of the provider.

Pros

- Widespread popularity: PayPal’s extensive user base ensures a high level of trust and recognition among customers.

- Ease of use: The platform is known for its user-friendly interface and seamless integration with Magento 2.

- Robust security: PayPal’s strong fraud protection measures provide secure transactions for both merchants and customers.

Cons

- Fees: PayPal’s transaction fees can be higher compared to some other payment gateways, particularly for international transactions.

- Availability: While PayPal is widely accepted in many countries, it may not be available in all regions, limiting its reach for some businesses.

Stripe

As a popular payment gateway among Magento users, Stripe offers a seamless and user-friendly experience for customers during the payment process.

Features

- PCI-compliant payment processing: Stripe ensures secure payment processing in compliance with Payment Card Industry (PCI) standards.

- Support for multiple payment methods: The platform supports major credit cards and alternative payment options such as Apple Pay and Google Pay.

- Customizable checkout experience: Stripe allows for a tailored checkout experience, reducing cart abandonment rates and providing convenience and security for both customers and merchants.

- Global reach: Stripe operates in 47 countries worldwide, including Europe, Australia, and North America, making it a viable choice for businesses looking to expand beyond traditional channels.

- Scalability and customizability: Stripe’s developer-driven approach allows for greater flexibility in terms of customization and scalability, making it an excellent choice for businesses of all sizes and needs.

- Support for 100+ currencies: This feature enables businesses to cater to a global customer base.

- Mobile payments and one-click checkout: Stripe simplifies the payment process, making it easier and more convenient for customers to complete their transactions.

- 24/7 tech support: Stripe provides round-the-clock technical support to ensure smooth and uninterrupted payment processing.

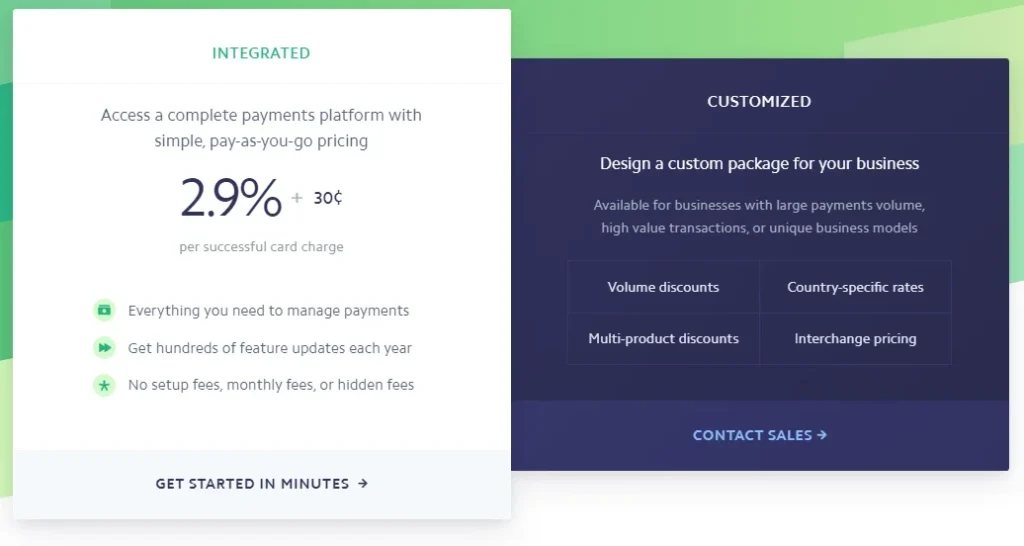

Costs

- Transaction fees: Stripe charges 2.9% + $0.30 per transaction.

- Additional costs: Additional fees may apply for alternative payment methods such as Apple Pay and Google Pay.

Integration with Magento 2

Stripe can be easily integrated with Magento 2 using the Stripe Payment module. However, keep in mind that integrating Stripe via API will require some programming knowledge. You can also try downloading a ready-made Magento payment gateway extension from a marketplace, but make sure it’s compatible with your store.

Pros

- No setup or monthly fees: Stripe’s transparent pricing structure is based on a flat rate per transaction, with no setup or monthly fees.

- Low chargeback fees: Compared to other payment gateways, Stripe offers relatively low chargeback fees.

Cons

- Limited fraud protection features: Unlike some other payment gateways, Stripe relies on third-party integrations for fraud protection features.

Braintree

Braintree, a payment solution powered by PayPal, caters to businesses of all sizes, from small shops to large enterprises. As a full-stack eCommerce payment platform, Braintree operates in 44 countries and supports over 130 currencies. Well-known for its smooth checkout experience and ease of use, Braintree is trusted by big businesses like Airbnb and LivingSocial.

Features

- Multiple payment options: Accept major credit cards, eWallets, and local payment methods.

- Recurring billing: Enable subscription-based payment models for your customers.

- Data encryption and fraud prevention tools: Ensure secure transactions and protect against fraudulent activity.

- Braintree Marketplace: A separate solution tailored to marketplace businesses, offering scalability and customization with the help of the right software development team.

Pricing

- Cards and Digital Wallets: 2.59% + $0.49 per transaction (standard merchants); 1.99% + $0.49 per transaction (charitable organizations)

- PayPal and PayPal Credit: Fees based on your PayPal account

- Venmo (US only): 3.49% + $0.49 per transaction

- ACH Direct Debit: 0.75% per transaction (capped at $5)

Pros

- Smooth checkout experience: Braintree’s user-friendly interface encourages repeat orders by providing a high level of safety and ease of use.

- Flexible payment options: Cater to a wide range of customers by supporting various payment methods.

- Magento integration: Braintree can be configured directly in the admin panel of a Magento store, streamlining the setup process.

Cons

- Transaction fees: While competitive, transaction fees can still accumulate for businesses with high sales volumes.

Authorize.Net

Established in 1996, Authorize.Net has become an incredibly popular payment gateway in the US, serving over 430,000 merchants and processing nearly $150 billion in annual transactions. Catering to small, medium, and enterprise-sized businesses, Authorize.Net offers a secure and affordable payment service that stands out from competitors like PayPal and Stripe due to its straightforward interface and ease of use.

Features

- Wide range of payment methods: Accept credit and debit cards from major providers like Visa, MasterCard, Discover, and American Express, as well as alternative payment methods like Apple Pay, Google Pay, and e-checks.

- Flexible automatic payment options: Offer monthly recurring and installment payments to your customers.

- Simple checkout functionality: Streamline the payment process for your customers.

- Custom digital invoicing: Easily send invoices to customers via email.

- Merchant account support: Get set up with a merchant account if needed and benefit from a virtual point-of-sale (POS) system.

Costs

Authorize.Net offers two pricing plans:

- Pricing Plan #1: $25 monthly gateway fee + 2.9% per transaction + $0.30 per transaction.

- Pricing Plan #2: $25 monthly gateway fee + $0.10 per transaction + $0.10 daily batch fee.

Pros

- Affordable pricing: With two pricing plans, Authorize.Net caters to businesses of all sizes without breaking the bank.

- Ease of use: The straightforward interface makes it simple for merchants to manage their payment processing.

- Out-of-the-box Magento integration: Although the Authorize.net Direct Post has been deprecated for security reasons, you can still integrate Authorize.Net as a Magento Marketplace extension.

- Wide range of payment options: Accept various payment methods to cater to different customer preferences.

Cons

- Transaction fees: While affordable, transaction fees can still accumulate for businesses with high sales volumes.

CyberSource

CyberSource, founded in 1994 and now a part of Visa, is a renowned payment gateway solution provider. CyberSource offers secure and user-friendly transactions, making it a strong contender for Magento store owners or e-commerce businesses seeking a reliable payment processing solution.

Features

- Global payment processing: CyberSource supports payment processing in over 190 countries and territories, making it ideal for businesses targeting international customers.

- Wide range of payment methods: With support for over 40 payment methods, including major credit and debit cards, digital wallets, and local payment methods, CyberSource caters to diverse customer preferences.

- Fraud management solutions: CyberSource’s advanced fraud management tools, such as Decision Manager, help protect your business from fraudulent activities and minimize chargebacks.

- Tokenization and encryption: CyberSource ensures secure transactions by employing tokenization and encryption to protect sensitive customer information.

- Integration with Magento 2: CyberSource can be easily integrated with Magento 2 through an extension, enabling seamless payment processing for your online store.

Pros

- Global reach: CyberSource’s support for numerous countries and payment methods makes it suitable for businesses targeting a worldwide audience.

- Fraud protection: CyberSource offers advanced fraud management solutions to help protect your business from fraud and minimize chargebacks.

- Secure transactions: Tokenization and encryption ensure the security of customer information during transactions.

Cons

- Pricing: CyberSource’s pricing may be less competitive compared to other payment gateway options, with varying transaction fees and potential monthly fees.

Costs

CyberSource’s pricing structure includes various fees depending on the payment method and country. The transaction fees for credit card processing can be found on their official fee documentation.

Square

Square is a popular payment processing gateway for Magento stores, recognized for its secure and user-friendly transactions. Founded in 2009, Square has gained a reputation as one of the top payment gateways due to its intuitive interface, free card reader, and transparent pricing structure. It allows accepting online payments using an online platform or mobile phone, making it a valuable choice for Magento 2 store owners.

Features

- Square for Payments: Power online sales with full support for payments, refunds, voids, and cancellations. Use Square POS software and hardware for in-person transactions and manage sales in Magento.

- Apple Pay and Square Gift Cards: Customers can pay using Apple Pay and Square Gift Cards on your website.

- Card Storage: Customers can securely save credit cards to Square for future orders.

- Analytics and Reporting: Access industry-leading data security, analytics, and reporting software across locations, employees, and devices.

- Fraud Prevention and Dispute Management: Proactively prevent fraud and manage disputes with dedicated support.

- Pickup Locations: Allow customers to choose a location for pickup, sell inventories from different locations, and integrate orders into the selected location.

- Subscriptions: Process recurring payments with Square invoices, create subscription plans, and manage subscriptions on the Magento admin grid.

- Product Catalog: Automatically sync your catalog between Magento and Square, ensuring it stays up-to-date.

- Inventory Management: Track inventory automatically, considering both POS and in-person transactions.

- Customer Management: Access a 360-degree view of your customers, linking their in-person and online transactions, and keep customer data in sync between Square and Magento.

Costs

- Transparent Pricing: Square offers custom pricing packages for qualified businesses with annual revenues over $250K and an average ticket size over $15.

- Transaction Fees: 2.9% + 30¢ per online transaction; 2.6% + 10¢ per in-person transaction (US pricing).

Pros

- Ease-of-use: Square’s user-friendly interface makes it a popular choice for small business owners running eCommerce stores.

- Competitive rates and transparent fees: Square offers competitive transaction fees, making it an affordable solution for businesses.

- Powerful tools and analytics: Access a range of tools and analytics to optimize your payment processing experience.

Cons

- Limited currency and country support: Square only supports seven currencies and eight countries, potentially limiting your store’s reach to international customers.

- Transaction fees: Square incurs transaction fees per sale made on the platform, which can add up over time.

Amazon Pay

Launched in 2007, Amazon Pay is a powerful and reliable payment gateway backed by the retail giant Amazon. Designed to provide a seamless and user-friendly experience for online shoppers, it has become an ideal choice for Magento 2 store owners. Amazon Pay allows customers to complete all their financial transactions on-site using just one account, which results in a more streamlined checkout experience. The payment solution supports 12 currencies and multiple languages, catering to a diverse range of customers.

Features

- Integration with Magento: Amazon Pay can be easily integrated with Magento, making it a convenient option for merchants using this platform.

- Support for multiple currencies and languages: Amazon Pay supports 12 currencies and multiple languages, making it ideal for businesses catering to a global audience.

- Streamlined checkout experience: Customers can use their existing Amazon account information to complete transactions quickly and easily without having to enter billing or shipping details repeatedly.

- Fraud protection: Amazon Pay offers robust fraud protection features that help merchants secure transactions and minimize chargebacks.

- Recurring payments: The platform supports recurring payments and provides various options for local payment methods.

- Encrypted data exchange: All data exchanged during payment operations is encrypted, ensuring payment security.

Costs

- No setup or monthly fees: Amazon Pay has the same transaction fees as Stripe, charging 2.9% + $0.30 per transaction.

Integration with Magento 2

To activate the “Pay with Amazon” button in your Magento store, follow these steps:

- Go to your admin panel > Stores > Configuration > Sales > Payment Method > Configure Amazon Pay.

- Follow the instructions specified on the official Amazon Pay website.

Pros

- User-friendly and convenient: Amazon Pay allows customers to complete transactions using their existing Amazon account information.

- Robust fraud protection measures: These features help minimize chargebacks and keep transactions secure, providing peace of mind for business owners.

- Easy integration with Magento 2: Amazon Pay can be easily integrated with Magento 2, enabling merchants to accept payments in currencies other than their base currency.

Cons

- Transaction fees: Amazon Pay charges 2.9% + $0.30 per transaction, which may cut into profits for small businesses.

- Data privacy concerns: Some customers may feel uncomfortable sharing their data with Amazon, potentially affecting their willingness to use Amazon Pay.

The 7 Best Magento Payment Gateways – Comparison At A Glance

Understanding the fees and pricing, features and functionalities, customer support and integration options, as well as the pros and cons of various payment gateways, are essential to make an informed decision for your Magento store.

Here’s a comparative analysis of the top 7 best Magento payment gateways discussed in this article:

| Magento Payment Gateways | Fees and Pricing | Features and Functionalities | Customer Support and Integration Options | Pros | Cons |

| PayPal | 2.9% + $0.30 per transaction (standard pricing plan) | Secure transactions, fraud protection, flexibility in accepting payments from various countries | Strong reputation, reliable customer service, seamless integration with Magento | Widely recognized and trusted, supports multiple currencies, no monthly fees | Higher transaction fees, PayPal account required for customers |

| Stripe | No monthly or setup fees; 2.9% + $0.30 for every successful payment | Tools for recurring payments, support for Apple Pay and Google Pay | Excellent integration options with plugins for Magento 1 & 2, dedicated developer tools | Supports multiple payment methods, easy integration, competitive fees | Not available in all countries, some customers may not be familiar with it |

| Braintree | Varies based on sales volume | Advanced security features, PCI compliance, anti-fraud system (Kount Complete), support for local payment methods (iDEAL, Sofort) | Easy-to-use API, access to fraud prevention tools, support for multiple currencies, responsive technical support | Owned by PayPal, supports multiple payment methods, good security features | Requires a separate merchant account, not available in all countries |

| Authorize.Net | Varies | Support for multiple credit card processors, virtual terminal option for offline transactions | Seamless integration with Magento, comprehensive documentation available online or via email | Trusted and reliable, great support, flexible subscription options | Higher setup and monthly fees, additional payment gateway fee |

| CyberSource | Varies | Built-in tax management capabilities for international merchants | Efficient integration with Magento, strong customer support | Robust security and fraud prevention tools, good customer support | Higher setup and monthly fees, not ideal for small businesses |

| Square | Varies | All-in-one platform for online and card-present transactions, compatible with hardware devices like Square Reader | Easy integration with Magento, dedicated customer support | Easy setup and integration, no monthly fees, supports omnichannel sales | Higher transaction fees, limited to supported countries |

| Amazon Pay | Varies | Simplified checkout, reduced cart abandonment by allowing customers to use stored Amazon account information | Comprehensive documentation, responsive customer support, seamless integration with Magento | Trusted by Amazon customers, easy integration, supports multiple currencies | Transaction fees can be higher, limited to supported countries |

Which Payment Gateway Is Best For Your Store?

Here are some tips to help you make the right decision:

- Consider your target audience and their preferred payment methods.

- Prioritize security features and fraud protection.

- Compare pricing, fees, and overall value.

- Ensure easy integration with Magento.

- Look for customization and flexibility.

- Check for responsive customer support.

- Opt for a reputable and reliable provider.

Also, read PayPal vs Stripe: Which one is better for you?

Bottom Line

With so many options available, choosing the best payment gateway for your Magento store can be overwhelming. However, by considering key factors such as security and encryption, compatibility with your Magento version, transaction fees and pricing, supported payment methods, integration experience, and user interface, you can make an informed decision on which payment gateway is perfect for you.

Ultimately, the right choice will depend on your business needs and target audience, but with this guide of the top 7 best Magento Payment Gateways; PayPal, Stripe, Braintree Authorize.Net CyberSource Square, and Amazon Pay – you have all the information needed to begin accepting online payments confidently!

FAQs

How do I choose the best payment gateway for my Magento store?

Choosing a payment gateway that offers secure transactions at competitive rates is key when selecting a solution for your online store. Factors to consider may include integration with other business software or services you use, such as accounting tools or inventory management systems.

Can I integrate multiple payment gateways into my Magento store?

Yes, many businesses utilize more than one payment gateway in order to offer their customers different options and flexibility when it comes time to check out.

What are some security measures I should look for in a Magento payment gateway provider?

Reputable providers typically have measures like SSL encryption and fraud detection tools designed to keep personal information safe from cybercriminals. Additionally – It’s important to examine PCI compliance on the part of service provider companies.

Top 7 Best Magento Payment Gateway Options: The Ultimate Guide