Cyber-attacks have escalated in both propensity and severity, posing significant risks to businesses worldwide. It is estimated that cybercrime will result in an astonishing $8 trillion USD in losses by 2023, as reported by Cybersecurity Ventures, underscoring the urgency of robust cybersecurity measures.

Even the most sophisticated cybersecurity systems are not invincible to breaches, and the aftermath can be financially devastating. Surprisingly, despite these statistics, the global cyber insurance market was valued at only USD 16.66 billion in 2023. This indicates a significant gap in cyber risk awareness among businesses and the insurance industry.

In response to these escalating threats, businesses of all sizes are increasingly turning to insurance policies for comprehensive cyber coverage. Cyber insurance covers a wide range of protections that are highly relevant in the current digital environment. They safeguard a company’s network security and privacy obligations, providing coverage for security responses, data restoration, ransom demands, reputational harm, system failures, and other potential damages that could disrupt business operations. By adopting such policies, businesses can reduce potential financial losses and manage the complex cybersecurity landscape more skillfully.

As businesses strengthen their defenses, it’s important to be aware of common misconceptions that can harm their business. Let’s dive into a few key aspects of cyber insurance and how businesses can effectively leverage insurance policies to address the rising risks they face.

What is cyber insurance or cybersecurity insurance?

Cyber insurance, also known as cybersecurity insurance, is a specialized type of coverage that businesses can procure to mitigate the financial risks associated with cyber threats. This coverage serves as a safety net, offering protection against financial losses stemming from various cyber incidents, such as data breaches, network damage, legal liabilities, and business interruptions.

Primarily, cyber insurance covers a company’s liability in the event of a data breach involving sensitive customer information, including Social Security numbers and credit card details. Beyond this, it broadens its scope to encompass elements of cyber liability insurance. This aspect provides coverage for costs arising from data breaches and cyberattacks on your business, encapsulating lost income, public relations efforts, and legal fees, among other expenses.

Consider, for instance, a scenario where a cyberattack on a company’s network results in a data breach, exposing its customers’ personal information. The affected customers may seek legal recourse against the company, alleging negligence, breach of contract, or violation of privacy laws. In such circumstances, the company would greatly benefit from a cyber insurance policy that covers third-party liability, enabling it to handle the ensuing legal fees, settlements, or judgments.

Why do you need cyber insurance?

Cyber insurance is important for businesses of all sizes and industries, especially those that handle sensitive or confidential information, such as personal data, financial records, intellectual property, or trade secrets. Cyberattacks and data breaches can cause significant financial losses, legal liabilities, reputational harm, and operational disruptions for businesses.

Cyber insurance can be a lifesaver for businesses dealing with the aftermath of cyber events. It can also help businesses prevent or reduce the likelihood of a cyber incident by providing them with risk assessment, security awareness training, incident response planning, and other cyber risk management services. Cybersecurity insurance is not a substitute for good cybersecurity practices but rather a complement that can enhance the resilience and recovery of businesses in the face of cyber threats.

Here are some reasons why businesses need cyber insurance:

- Mitigating Financial Loss: Data breaches and cyberattacks can be costly. Cyber insurance helps protect businesses from significant financial losses by covering these expenses. It allows businesses to transfer the financial risk of a cyber attack to an insurance company, reducing the financial burden associated with cybersecurity incidents.

- Legal and Regulatory Compliance: Many jurisdictions require businesses to notify customers and regulatory bodies in the event of a data breach, which can be a costly process. Cyber insurance can help cover these costs.

- Reputation Management: A data breach can significantly damage a business’s reputation. Cyber insurance often includes coverage for PR efforts to manage the fallout and restore a company’s image.

- Business Continuity: In the event of a severe cyber attack, a business may need to halt operations. Cyber insurance can cover the loss of income during this period, helping ensure business continuity.

- Access to Experts: Many cyber insurance policies provide access to experts who can help manage a cyber incident. This includes legal experts, PR firms, and cybersecurity professionals.

What types of risks are covered by cyber insurance?

Cyber insurance offers a crucial line of defense against a wide range of cyber risks. However, the specifics of what is covered can vary greatly between different insurance providers and policies. So, businesses should carefully review policy details and consult with insurance professionals to ensure they are adequately protected against potential cyber threats. Cyber insurance coverage typically includes two types of risk coverage:

a. First-Party Coverage

First-party cyber insurance coverage refers to losses that directly impact an enterprise. This type of coverage is designed to help companies respond to and recover from data breaches on their own network or systems.

First-party cyber insurance typically covers the following:

- Data Breaches: Cyber insurance covers the insured’s liability for a data breach that involves sensitive customer information, such as credit card numbers, health records, and social security numbers, which could be stolen or damaged by a cyber attack.

- Network Security and Privacy Liability: It provides coverage for security responses, data restoration, ransom demands, reputational harm, system failures, and various other damages that could disrupt business operations.

- Business Interruption: Cyber insurance compensates for income loss resulting from a cyber event or data loss.

- Ransomware and Cyber Extortion: It covers the costs associated with cyber extortion, such as responding to ransomware attacks where hackers demand money to restore access to the network.

- Reputational Damage: Cyber insurance provides coverage for PR and other related costs to mitigate reputational damage following a cyber attack.

- Digital Asset Restoration: This covers the cost of recollecting, restoring, or replacing data or programs that have been lost, stolen, or altered.

- Legal Fees: Cyber insurance also covers legal fees associated with cyber incidents. This can include costs related to litigation, regulatory fines, and penalties.

b. Third-Party Coverage

Third-party cyber insurance coverage refers to losses suffered by other enterprises due to having a business relationship with the affected organization. This type of coverage is designed to help pay for lawsuits caused by data breaches on a client’s network or systems.

Third-party cyber insurance typically covers the following:

- Supply Chain Attacks: Cyber insurance provides coverage for losses resulting from attacks on the supply chain.

- Cloud-Based Attacks: It covers the losses resulting from attacks on cloud-based services.

- Social Engineering: It provides coverage for losses resulting from social engineering attacks.

- Mobile Devices: Cyber insurance covers losses resulting from attacks on mobile devices.

- Poor Post-Attack Practices: It provides coverage for losses resulting from poor practices after a cyber attack.

What isn’t covered by cyber insurance?

Cyber insurance is not a panacea for all possible cyber risks, and there are some common exclusions and limitations that businesses should be aware of. Here are some of the main risk categories that cyber insurance does not cover:

Lack of security protocols

Cyber insurance policies may exclude or limit coverage for losses resulting from the insured’s failure to maintain adequate security standards, such as updating software, patching vulnerabilities, encrypting data, or implementing firewalls. This means that businesses cannot rely on cyber insurance as a substitute for implementing robust cybersecurity measures; rather, they need to demonstrate that they have taken reasonable steps to prevent or mitigate cyber incidents.

Internal bad actors

Cyber insurance policies may also exclude or limit coverage for losses caused by the insured’s own employees, contractors, or other authorized users who intentionally or negligently compromise the security of the network or data. This means that businesses need to have effective policies and procedures to monitor, train, and discipline their staff, as well as conduct background checks and limit access privileges.

Certain human errors

Cyber insurance policies may not cover losses resulting from certain human errors, such as accidentally deleting or overwriting data, misconfiguring systems, or sending sensitive information to the wrong recipient. This means that businesses need to have backup and recovery plans, as well as educate their staff on how to avoid common mistakes and report incidents promptly.

Failure to follow compliance procedures

Cyber insurance policies may not cover losses resulting from the insured’s failure to comply with applicable laws, regulations, or contractual obligations, such as data protection, privacy, or security standards. This means that businesses need to be aware of their legal and contractual responsibilities and implement appropriate measures to ensure compliance.

Acts of war or terrorism

Cyber insurance policies may not cover losses resulting from war, invasion, or terrorism, regardless of any other cause or event contributing to the loss, although some cyber insurers may include an exception for cyber terrorism.

Failure of timely reporting

Cyber insurance policies may require the insured to report any cyber incident or claim to the insurer within a specified time frame, usually as soon as possible or within a few days. Failure to do so may result in the denial or reduction of coverage, as the insurer may argue that the delay has prejudiced its ability to investigate, defend, or settle the claim. This means that businesses need to have clear and effective incident response plans and communicate with their insurer as soon as they become aware of a cyber incident or claim.

Prior acts

Cyber insurance policies may include a retroactive date, which excludes or limits coverage for any acts, incidents, or circumstances that occurred before a certain date, usually the date of inception of the policy. This means that businesses may not be covered for cyber incidents or claims that are discovered after the retroactive date, even if they were unaware of them at the time.

Other exclusions and limitations

Cyber insurance policies may also contain other exclusions and limitations that are specific to the insurer, the industry, or the risk profile of the insured, such as bodily injury, property damage claims, regulatory fines, cyber crimes committed by employees, human error, intellectual property infringement, non-digital perils, and costs related to system upgrades.

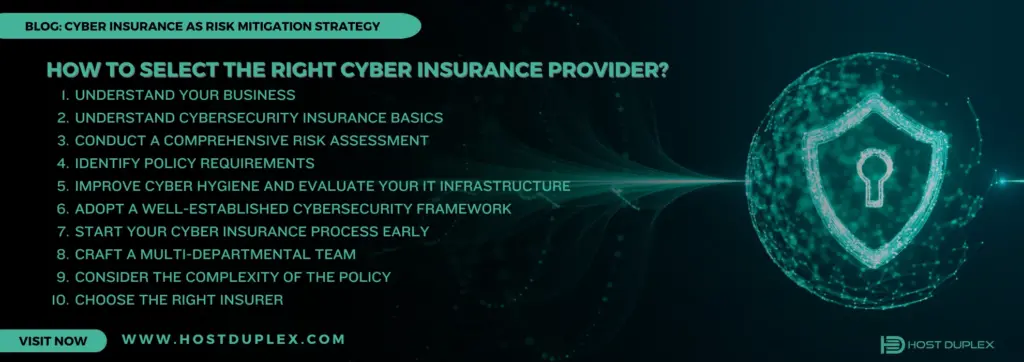

How to select the right cyber insurance provider?

Selecting the right cybersecurity insurance policy for your business is a critical task that requires careful consideration and planning. Here are some steps you can follow:

1. Understand Your Business

Begin by thoroughly understanding the nature of your business operations. Identify the specific types of data you handle, how it is stored, and who has access to it. By having a clear understanding of your business processes and data infrastructure, you can effectively assess the vulnerabilities that may arise in the event of a cyber attack and take appropriate measures to mitigate those risks.

2. Understand Cybersecurity Insurance Basics

Familiarize yourself with the fundamental concepts and principles of cyber insurance. Gain knowledge about what cyber insurance typically covers and what it does not cover. Understand the various factors that may influence the coverage options available to you, such as the size of your business, the industry you operate in, and the specific cyber risks you face.

3. Conduct a Comprehensive Risk Assessment

Perform a thorough evaluation of your current cybersecurity framework. Identify potential risks and vulnerabilities within your systems and networks. This assessment will help you determine the specific coverage requirements you need in order to adequately protect your business against cyber threats.

4. Identify Policy Requirements

Analyze your coverage needs by considering the unique characteristics of your business. Take into account the security measures you have in place, such as firewalls, encryption protocols, and employee training programs. Also, assess the potential risks associated with your industry, including regulatory compliance requirements, data breach incidents within your sector, and the impact of emerging cyber threats.

5. Improve Cyber Hygiene and Evaluate Your IT Infrastructure

Prioritize proactive steps to enhance your cybersecurity practices. Put strong cybersecurity measures in place, and assess how well your current IT setup is working. By showcasing strong preventive measures, like implementing multi-factor authentication, securing remote desktops, and quickly patching critical vulnerabilities, you can make your business appear less hazardous to cyber insurers, which may lead to more favorable insurance premiums.

6. Adopt a Well-Established Cybersecurity Framework

One effective measure to enhance your organization’s security posture and mitigate risks is to adopt a well-established cybersecurity framework, such as those provided by the U.S. National Institute of Standards and Technology (NIST), the Center for Internet Security (CIS), and MITRE. These frameworks offer comprehensive guidance and best practices for establishing foundational cybersecurity processes. By implementing these proven frameworks, you can strengthen your organization’s resilience to cyber threats and reduce risks.

7. Start Your Cyber Insurance Process Early

Initiate the cyber insurance procurement process well in advance. Due to the increasing frequency and sophistication of cyberattacks, insurers now require more comprehensive information from organizations. Starting the buying process three to six months ahead of time allows for thorough evaluation, negotiation, and customization of the policy to align with your specific business needs.

8. Craft a Multi-Departmental Team

Involve representatives from various departments within your organization when selecting a cyber insurance policy. This multi-departmental approach ensures that all aspects of your business are considered, including IT, legal, finance, and risk management. By incorporating diverse perspectives, you can make more informed decisions about the coverage that best suits your organization’s requirements.

9. Consider the Complexity of the Policy

Pay careful attention to the terms and conditions of the cyber insurance policy. Avoid overly complex policies that may contain opaque clauses or exclusions. Thoroughly compare different policies to understand their coverage scope and the conditions under which they pay out. By carefully evaluating and understanding the terms, you can make an informed decision that aligns with your business objectives and risk tolerance.

10. Choose the Right Insurer

Select an insurer who has a deep understanding of your industry and can provide a tailored cyber insurance solution. Seek recommendations from trusted business partners, industry peers, and professional networks. Their experiences and insights can offer valuable guidance in choosing an insurer that can effectively address your unique business needs and provide responsive and reliable coverage.

The right cyber insurance policy for your business will depend on your specific needs and circumstances. It’s important to do your research and consider seeking professional advice to ensure you’re adequately protected. An experienced cyber insurance broker can help you understand your risk profile, evaluate policy options, and negotiate terms on your behalf. Their vast experience in the market and deep understanding of cyber risks can provide you with valuable insights and guide you through the process of securing the most suitable coverage for your organization.

Some of the popular cybersecurity insurance brokers and companies are:

- AIG CyberEdge

- Allianz Cyber Protect

- AXA XL Cyber Insurance

- Beazley USA Insurance Group

- Chubb Cyber Insurance

- Hiscox

- Zurich North America

- Travelers.

What are the risks of cyber insurance?

Though cyber insurance offers a safety net against potential financial losses caused by cyber threats, it also encompasses several risks that businesses should be aware of. Here are some of the risks of cyber insurance:

1. Cyber insurance does not cover all types of cyber risks

Cyber insurance policies may vary in terms of what they cover and what they exclude. Businesses should carefully review their policies and understand the scope and limitations of their coverage.

2. Cyber insurance may not cover the full extent of the losses

Cyber insurance policies may have limits, deductibles, sub-limits, and co-insurance clauses that affect the amount of compensation that businesses can receive. For example, a policy may have a limit of $10 million, but a cyber incident may cause losses of $15 million. In that case, the business would have to bear the remaining $5 million.

3. Cyber insurance may not be available or affordable for some businesses

Cyber insurance is a relatively new and evolving market, and there may not be enough supply or demand for some types of businesses or industries. For example, small and medium-sized businesses may face challenges in finding suitable and affordable cyber insurance policies, as insurers may perceive them as high-risk or low-profit customers. Similarly, businesses in critical infrastructure sectors, such as energy, transportation, or health care, may face higher premiums or stricter requirements, as insurers may consider them as high-exposure or high-impact customers.

4. Cyber insurance may create moral hazard or adverse selection problems

Cyber insurance may create incentives for businesses to reduce their investment in cybersecurity measures, as they may rely on their insurance to cover their losses. This is known as a moral hazard, and it may increase the likelihood and severity of cyber incidents. Conversely, cyber insurance may attract businesses that have poor cybersecurity practices or high exposure to cyber risks, as they may seek to transfer their losses to insurers. This is known as adverse selection, and it may increase the costs and claims for the insurers.

5. Cyber insurance may not keep pace with the changing cyber threat landscape

Typically, cyber insurance is based on historical data and actuarial models that may not reflect the current or future trends and scenarios of cyberattacks. Cyber threats are constantly evolving and becoming more sophisticated, diverse, and widespread, and they may pose new and unforeseen challenges for businesses and insurers. For example, cyberattacks may involve emerging technologies, such as artificial intelligence, quantum computing, or 5G, or they may target new domains, such as cloud services, the Internet of Things (IoT), or smart cities.

How much does a typical cybersecurity policy cost?

The cost of a typical cybersecurity policy can significantly vary based on the scale of the business and its unique risk factors. As of 2023, for small businesses, the average annual cost of a cyber insurance policy typically ranges from $1,000 to $7,500, covering limits between $1 million and $2 million. Mid-sized businesses can expect to pay anywhere from $10,000 to $50,000 per year, while large enterprises may see costs exceeding $200,000 annually.

Several factors can influence these costs. Firstly, the industry sector matters: businesses in high-risk industries such as healthcare or finance will likely face higher premiums.

Secondly, the size and scope of the business’s online presence could significantly impact the cost. A larger online footprint often correlates with higher risk and, thus, higher premiums.

Thirdly, the company’s past history with cybersecurity incidents may also affect the cost. Businesses with a history of breaches or claims are likely to face higher premiums due to the perceived increase in risk.

Lastly, the level of cybersecurity defenses and practices the business has in place can also influence the cost – robust cyber risk management practices can often help to lower premiums by reducing the perceived risk.

Conclusion: Is cyber insurance really worth it?

Cyber insurance is definitely a smart investment, especially for businesses that handle sensitive data, whether it’s stored on a network or in the cloud. It helps protect against financial losses from cyber incidents and can actually save you money in the long run. But cyber insurance shouldn’t be your only strategy. Your best approach is to build strong defenses against attacks, regardless of whether you’re insured for them.

Now, is cyber insurance mandatory? Legally, nope. However, it’s highly recommended for all businesses due to the skyrocketing rate of cyber threats. In fact, some experts predict that cyber insurance will become a requirement as it becomes increasingly vital to the economic health of most countries.

The specifics can vary greatly depending on the context of the cyber event, the covered business, and the insurance company. Therefore, it’s always recommended to consult with insurance companies and legal counsel to understand the cyber insurance and liability requirements of your business. Stay Protected!

Cyber Insurance as Risk Mitigation Strategy: A Complete Guide