Whether you’re running an e-commerce site, a subscription service, or a brick-and-mortar store, accepting payments from customers is the lifeblood of your business. According to a report by PPRO, retailers in the US risk losing 42% of their customers if they don’t offer their preferred payment methods. That highlights the importance of choosing the right payment processor for your business and customers.

With so many options available, Stripe and PayPal stand out as the most popular and widely used payment processors in the market. In this article, We’ll look at their costs, features, security, customer support, and more to help you understand what sets them apart and what they have in common. Let’s dive in and make sense of the Stripe vs PayPal dilemma!

What is Stripe?

Stripe is a global payment processor that enables businesses to accept payments online and in person. Founded in 2010, Stripe has become a popular choice for online businesses thanks to its robust API and seamless integration capabilities. With a strong focus on developers and customization, Stripe provides a wide range of features and tools, allowing businesses to create a tailored payment experience for their customers.

Why Choose Stripe?

Here are some reasons to choose Stripe for your payment processing needs:

- User-friendly API: Stripe’s API simplifies building custom payment solutions.

- Recurring billing: Stripe supports subscription-based services.

- In-person payments: Stripe Terminal enables card reader and mobile device transactions.

- Fraud prevention: Advanced algorithms detect potential fraud.

- Stripe Connect: Manages payment flows for marketplaces.

- Stripe Billing: Tools for invoices, subscriptions, and recurring billing.

What is PayPal?

PayPal is a well-established payment processor founded in 1998 that allows businesses and individuals to send and receive payments online. With over 361 million active users worldwide, PayPal has become synonymous with online transactions. Offering a user-friendly interface and a wide array of features, PayPal caters to businesses of all sizes. Like Stripe, PayPal supports various payment methods, including credit and debit cards, PayPal Credit, and digital wallets.

Why Choose PayPal?

Here are some reasons why PayPal is a great choice for payment processing:

- PayPal Checkout– Seamless on-site transactions for customers.

- Invoicing and billing– Simplified invoice creation with recurring billing and installment plans.

- In-person payments– Card readers and mobile payment solutions for physical stores.

- Fraud protection– Advanced security and fraud detection tools for transaction safety.

- PayPal Payments Pro– Enhanced customization and control for business payments.

- PayPal Business Loan– Working capital loans for eligible businesses.

Stripe vs PayPal: Cost comparison

At a glance, Stripe and PayPal offer similar services, allowing businesses to accept payments online, in-person, and through various digital channels. However, there are several notable differences in their pricing structures, supported platforms, and additional features.

Below is a quick cost comparison table highlighting the pricing, key features and services of both payment processors:

| Feature/Service | Stripe | PayPal |

| Transaction Fees | 2.9% + $0.30 per successful charge | 2.9% + $0.30 per transaction (US) |

| CRM | Integrates with third-party CRM tools | Integrates with third-party CRM tools |

| Security | PCI DSS Level 1 compliant | PCI DSS Level 1 compliant |

| Payment Gateway | Included | Separate (PayPal Payments Pro) |

| Merchant Account | Included | Included |

| Recurring Billing & Invoicing | Available | Available |

| Monthly Fees | None | None (for basic services) |

| Third-party Integration | Extensive list of integrations | Wide range of integrations |

| E-commerce Platform | Magento, BigCommerce, WordPress/WooCommerce | Magento, BigCommerce, WordPress/WooCommerce |

| Disputes & Chargebacks | $15 per dispute | $20 per dispute |

| Customer Support | Email, Live chat, phone support (24/7 Support) | Email, phone support, community forum (Limited) |

Stripe vs PayPal: 12 Key Similarities and Differences

We’ve narrowed down 12 essential factors to compare Stripe and PayPal, which will help us reach a definitive conclusion.

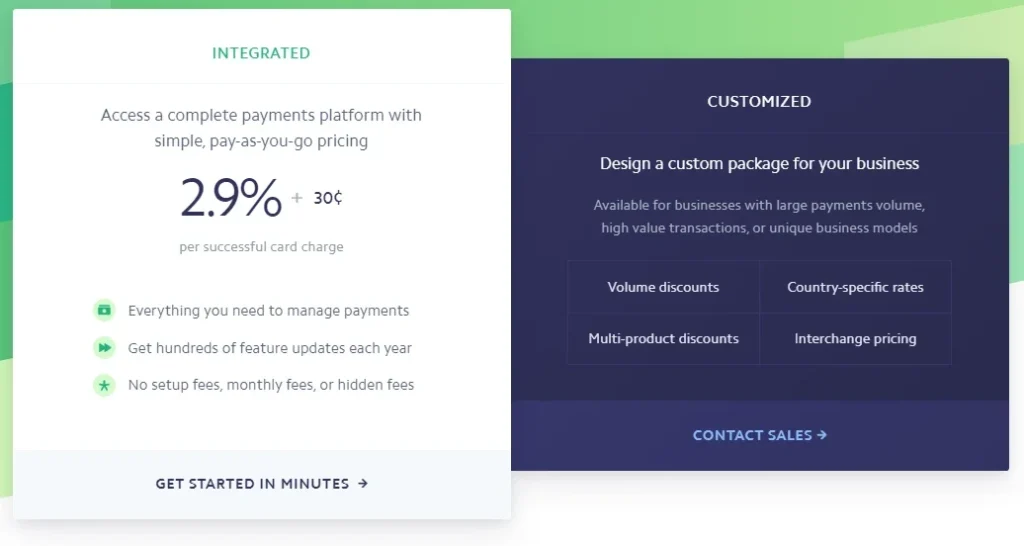

1. Costs

Stripe fees

Stripe charges a transaction fee of 2.9% + $0.30 for every successful charge. This fee applies to most businesses in the United States. However, customized pricing is available for companies with large payment volumes or unique business models.

Find detailed information on Stripe’s pricing here.

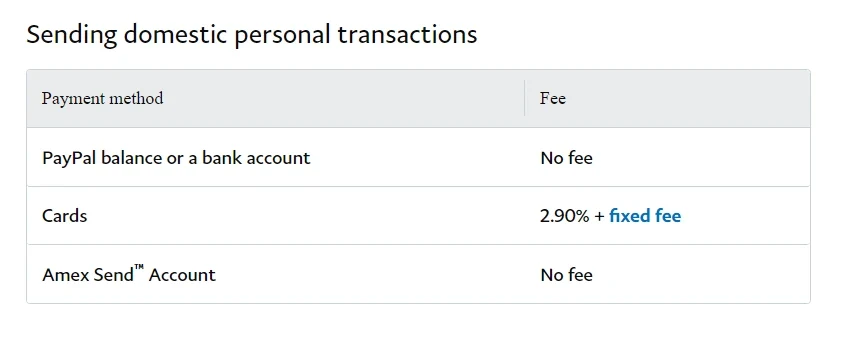

PayPal fees

PayPal also charges a transaction fee of 2.9% + $0.30 per transaction for sales within the US. For international sales, the fee is 4.4% plus a fixed fee based on the currency. Like Stripe, PayPal offers discounted rates for eligible nonprofit organizations and high-volume merchants.

Businesses can find more information on PayPal’s fees here.

Stripe vs PayPal: Comparing transaction

- Both Stripe and PayPal charge similar transaction fees for domestic sales.

- For international transactions, PayPal charges higher fees than Stripe.

- Both platforms offer customized pricing for high-volume merchants and nonprofit organizations.

2. CRM (Customer Relationship Management)

Stripe’s CRM Features

Stripe does not have a built-in CRM system but offers features like customer data storage, third-party CRM integrations (e.g., Salesforce, HubSpot, Zoho CRM), and reporting and analytics for improved customer management.

PayPal’s CRM Features

PayPal also lacks a built-in CRM system, but it provides features such as customer data storage, integration with popular CRM platforms (e.g., Salesforce, HubSpot, Zoho CRM), and comprehensive reporting and analytics for better customer understanding.

Stripe vs PayPal: Comparing CRM Features

- Neither Stripe nor PayPal has a built-in CRM system.

- Both platforms offer customer data storage and third-party CRM integrations.

- Both provide reporting and analytics to improve customer relationships.

3. Security and fraud prevention

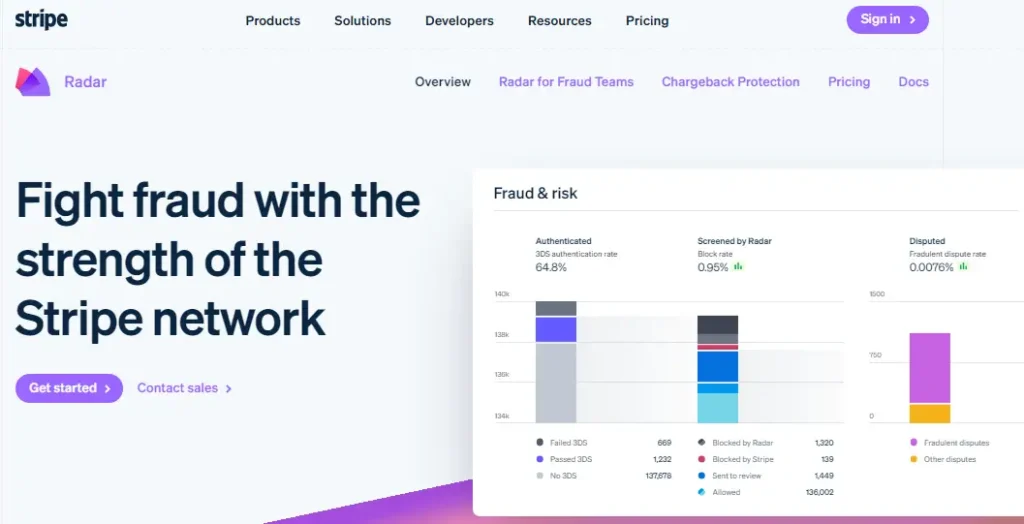

Stripe’s security measures and fraud prevention

Stripe takes security seriously, employing advanced security measures such as PCI DSS Level 1 compliance, SSL encryption, and tokenization to protect sensitive card data. Additionally, Stripe offers a suite of fraud prevention tools, including machine learning-based algorithms and Stripe Radar, which helps businesses identify and prevent fraudulent transactions.

PayPal’s security measures and fraud prevention

PayPal is also committed to providing a secure payment experience, with PCI DSS Level 1 compliance, SSL encryption, and tokenization to protect transaction data. PayPal offers its Fraud Protection service, which uses machine learning and advanced algorithms to detect and prevent fraudulent transactions.

Stripe vs PayPal: Comparing Security Features

- Both Stripe and PayPal employ stringent security measures and advanced fraud prevention tools to protect businesses and customers.

Also read Security Tips to Protect Your Store

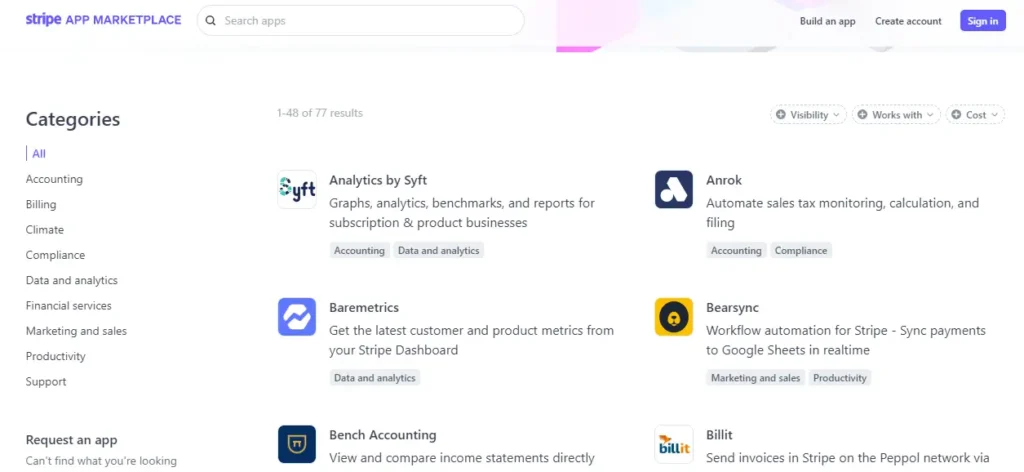

4. Third-party integration

Stripe’s integration options

Stripe offers a wide range of third-party integrations, allowing businesses to connect their payment processing services with various accounting, CRM, marketing, and analytics tools. Some popular integrations include QuickBooks, Xero, Salesforce, and Mailchimp.

Currently, Stripe offers around 70+ integrations.

PayPal’s integration options

PayPal also supports numerous third-party integrations, enabling businesses to connect their payment processing with other essential business tools. Popular integrations include QuickBooks, Xero, Salesforce, and HubSpot.

Stripe vs PayPal: Comparing third-party integrations

- Both Paypal and Stripe offer extensive third-party integration options, allowing businesses to streamline their operations and improve efficiency.

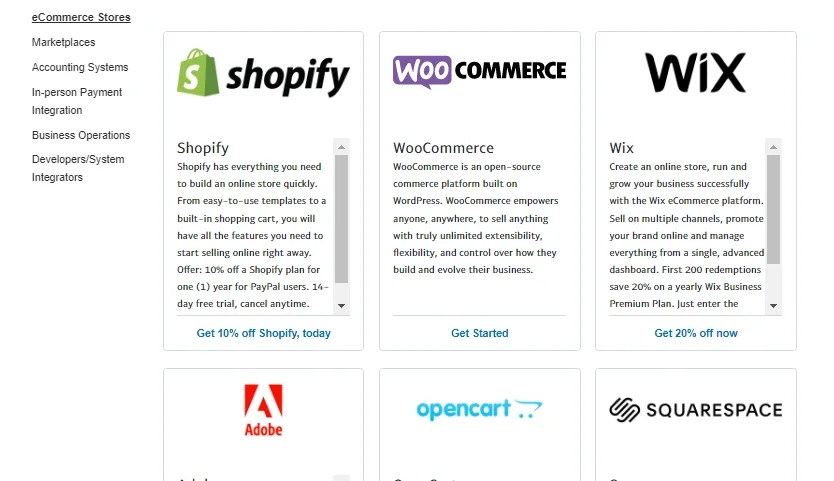

5. E-commerce platform support

Stripe’s platform support

Stripe is highly compatible with a wide range of e-commerce platforms, including Magento, BigCommerce, and WordPress/WooCommerce. This makes it easy for businesses to integrate Stripe into their online stores and start accepting payments quickly.

PayPal’s platform support

PayPal is also supported by many popular e-commerce platforms, such as Magento, BigCommerce, and WordPress/WooCommerce. This enables businesses to integrate PayPal into their online stores seamlessly and offer customers a familiar and trusted payment option.

Stripe vs PayPal: Comparing Platform Support

- Both Stripe and PayPal are supported by major e-commerce platforms, including Magento, BigCommerce, and WordPress/WooCommerce.

6. Disputes and chargebacks

Stripe’s handling of disputes and chargebacks

Stripe helps businesses manage disputes and chargebacks by providing tools and resources to track, respond to, and resolve issues. They offer a Disputes API that allows businesses to automate the dispute resolution process and minimize the risk of losing disputes. Stripe charges a $15 chargeback fee for each dispute but refunds it if the dispute is resolved in the merchant’s favor.

PayPal’s handling of disputes and chargebacks

PayPal offers a Resolution Center where merchants can manage and resolve disputes and chargebacks. They provide tools and resources to help businesses respond effectively and minimize the risk of financial loss. PayPal also charges a $20 chargeback fee for each dispute, which is refunded if the dispute is resolved in the merchant’s favor.

Stripe vs PayPal: Comparing disputes

- Both Stripe and PayPal provide tools and resources to help businesses manage disputes and chargebacks.

- Stripe has a lower chargeback fee compared to PayPal.

7. Customer Service and Support

Stripe’s customer support options

Stripe offers a variety of customer support options, including email, chat, and phone support. Additionally, they provide extensive documentation, guides, and a knowledge base to help businesses find answers to common questions and resolve issues.

PayPal’s customer support options

PayPal provides email and phone support for customer inquiries. They also offer a comprehensive help center, community forum, and a range of tutorials and guides to help users find the information they need.

Stripe vs PayPal: Comparing Customer Support

- Both Stripe and PayPal offer multiple customer support channels, including email and phone support.

- Stripe provides 24/7 support service, while PayPal offers limited support service.

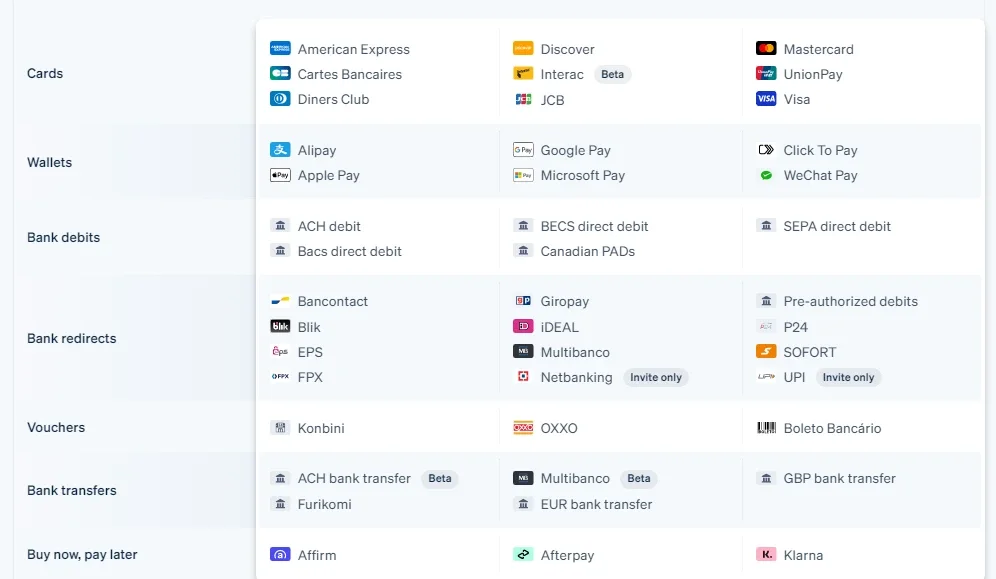

8. Payment methods

Stripe’s payment processing

Stripe is a powerful payment gateway that allows businesses to accept payments online and in person. It supports a wide range of payment methods, including credit card payments, debit card payments, ACH Payments, and popular digital wallets like Apple Pay and Google Pay.

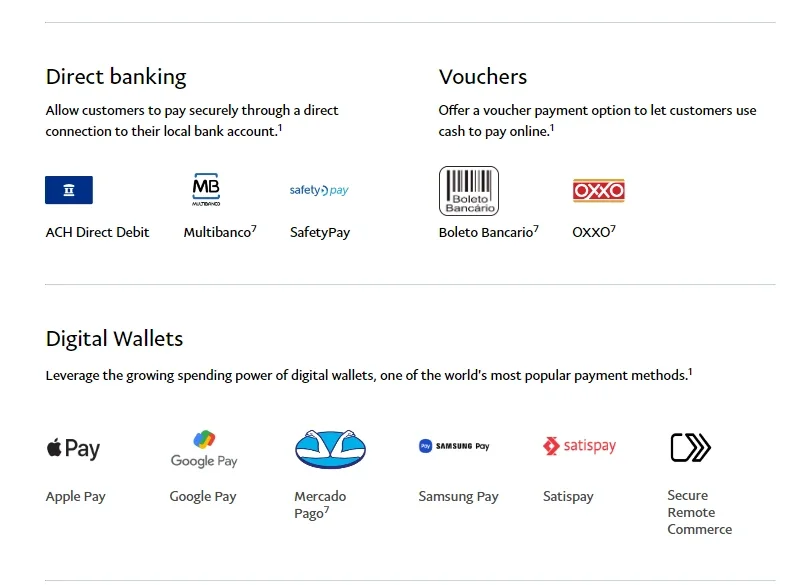

PayPal’s payment processing

PayPal enables businesses to accept online, in-person, and mobile payments. It supports credit cards, debit cards, PayPal balance payments, and digital wallets like Apple Pay and Google Pay.

PayPal also offers PayPal Credit, which allows customers to pay for their purchases over time.

Stripe vs PayPal: Comparing Payment Features

- Both Stripe and PayPal offer extensive payment processing capabilities.

- Both platforms support various payment methods, including credit cards, debit cards, and digital wallets.

- PayPal offers an additional financing option with PayPal Credit.

9. In-person transactions

Stripe’s In-Person Transactions

Stripe Terminal allows businesses to accept in-person payments using card readers and mobile devices. Stripe’s SDKs and APIs enable developers to build custom point-of-sale (POS) systems that integrate with Stripe’s payment processing services. This offers a seamless experience for customers and merchants, whether online or in a physical store.

PayPal’s In-Person Transactions

PayPal also offers solutions for brick-and-mortar businesses, providing card readers and mobile payment options for in-person transactions. PayPal’s card readers accept credit and debit cards, contactless payments, and mobile wallets, ensuring that businesses can cater to a wide range of customer preferences. In addition, PayPal’s POS integrations with partners like Vend and TouchBistro allow businesses to manage their inventory, sales, and customer data in one place.

Stripe vs PayPal: Comparing In-Person Transactions

- Both Stripe and PayPal offer in-person payment solutions through their respective programs, Stripe Terminal and PayPal Here.

- Both solutions allow businesses to accept payments using card readers and mobile devices.

- Both platforms provide businesses with tools to manage in-person transactions easily.

10. Recurring billing and subscriptions

Stripe’s recurring billing and invoicing features

Stripe offers a robust recurring billing service called Stripe Billing, which allows businesses to set up subscription plans, manage invoicing, and accept recurring payments. The service comes with a monthly fee starting at $20 per month.

PayPal’s recurring billing and invoicing features

PayPal also supports recurring billing and invoicing through its PayPal Payments Pro subscription, which costs $30 per month. With this service, businesses can create and manage subscription plans, send invoices, and accept recurring payments.

Stripe vs PayPal: Comparing billing features

- Both Stripe and PayPal offer recurring billing and invoicing features.

- Stripe Billing comes with a separate monthly fee, while PayPal’s recurring billing is part of the PayPal Payments Pro subscription.

11. Global Presence

Stripe’s Global Availability

Stripe is available in 40+ countries, including the US, Canada, the UK, Australia, and several European countries. It supports 135+ currencies, making it easy for businesses to accept payments from customers all around the world. However, Stripe’s availability may vary by country, with some countries having limited functionality or restrictions on certain features.

PayPal’s Global Availability

PayPal is available in 200+ countries and supports 25+ currencies, making it one of the most widely accepted payment solutions globally. However, availability and functionality may vary by country, with some countries having limited features or restrictions on certain transaction types.

Stripe vs PayPal: Comparing Global Availability

- Stripe is available in fewer countries than PayPal but supports more currencies.

- Both solutions have varying availability and functionality based on location, with some countries having limited features or restrictions on certain transactions.

- Stripe and PayPal both offer tools and features to manage currency conversions and cross-border transactions, such as multi-currency support and international payment processing.

12. Additional fees

Stripe’s monthly and additional fees

Stripe does not charge any monthly fees for its basic payment processing services. However, additional fees may apply for specific features like Stripe Billing (starting at $20 per month) and Stripe Connect (with a per-transaction fee of 0.5%).

PayPal’s monthly and additional fees

PayPal does not have any monthly fees for its basic services. However, for more advanced features like a virtual terminal and recurring billing, merchants need to subscribe to PayPal Payments Pro, which costs $30 per month.

Stripe vs PayPal: Comparing Monthly and Additional Fees

- Both Stripe and PayPal do not charge monthly fees for their basic services.

- Additional fees apply for specific features on both platforms.

Which Payment Processor Takes the Popularity Crown?

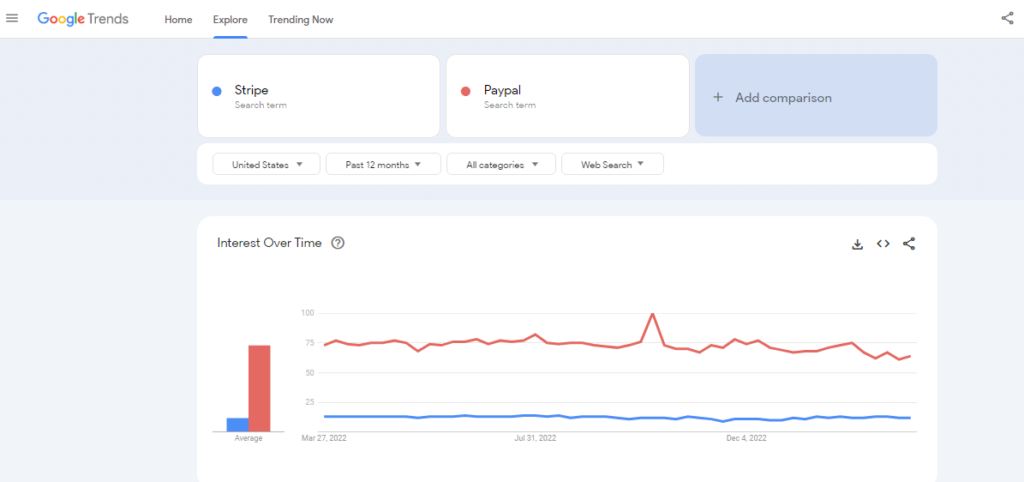

Stripe and PayPal both have a strong following and positive user feedback. Let’s examine their Google Trends data to understand better how they stack up against each other in the popularity game.

What Is Best for Your Business Needs: PayPal or Stripe?

Both Stripe and PayPal are excellent choices for online payment processing. Ultimately, the right platform for your business will depend on your specific needs, preferences, and budget. Take the time to evaluate each platform’s features, costs, and support options to make an informed decision.

When to Use Stripe?

Stripe is a versatile payment gateway that is suitable for a wide range of businesses. Here are some types of businesses that can benefit the most from using Stripe:

- E-commerce businesses

If you run an online store, Stripe’s user-friendly API, secure payment processing, and support for recurring billing can help you manage your transactions with ease. - Subscription-based business

Stripe’s built-in support for managing subscription-based services can help you automate your billing process and reduce churn. - Marketplaces

If you run a marketplace that connects buyers and sellers, Stripe Connect can help you manage payment flows and payouts to multiple parties. - Startups

Stripe’s easy-to-use API, flexible payment options, and advanced fraud detection tools can help startups scale their payment operations quickly and securely.

When to use PayPal?

PayPal is an excellent payment processing solution for small to medium-sized businesses due to its user-friendly interface quick and easy setup process.

Here are some businesses that can benefit from using PayPal:

- Freelancers and service providers

PayPal offers a simple invoicing system that makes it easy for freelancers and service providers to request payment from their clients. This feature is especially useful for businesses that work remotely or offer digital services. - Subscription-based businesses

PayPal’s recurring billing feature is ideal for businesses that offer subscription-based services, such as subscription boxes, membership sites, or online courses. - Non-profit organizations

PayPal offers special discounted rates for registered non-profit organizations, making it an attractive option for charities and other non-profits that need to process donations. - International businesses

PayPal is available in over 200 countries and supports transactions in over 100 currencies. This makes it a great choice for businesses that sell globally and need to accept payments in different currencies.

Stripe vs PayPal: Pros & Cons

Consider following the pros and cons of Stripe and PayPal before making a choice.

Stripe Pros

- Low pricing: Stripe is typically less expensive than PayPal for every transaction type.

- Full integration: Stripe offers many options, including POS systems and merchant accounts, making it a versatile platform for businesses.

- No setup, cancellation, or account maintenance fees: Stripe is cost-effective for seasonal businesses and offers an inexpensive trial to get started.

- Extensive customization: Stripe offers a wide range of tools, features, and plugins for various businesses.

- Quick account signup: Stripe offers an easy online signup process, but you may have to wait for equipment to be shipped if you need it.

Stripe Cons

- Suspended user accounts: If you process a bad transaction or have a technical issue, your account may be suspended until the issue is resolved.

- Chargeback fees: If you process a fraudulent transaction, you may be required to refund the transaction and incur up to a $15 fee.

- Mandatory credit card readers: To accept in-person payments, you’ll need to pay for a card reader, while PayPal offers a free reader.

- Complex setup: Customizing Stripe may be difficult for those without IT personnel or technical experience.

- Limited tax services: Businesses may need to calculate taxes themselves or hire a CPA.

PayPal Pros

- Easy setup: PayPal can be used straight out of the box, without requiring development experience or outside resources.

- Optional merchant account: PayPal is a digital wallet that holds funds, and bank accounts can be linked to transfer money.

- Simplified invoicing: PayPal’s invoicing tool is straightforward and easy to use.

- Streamlined payments: Automatic recurring payments can be easily set up, even in different currencies.

- Easy integration: PayPal integrates with popular e-commerce platforms like WooCommerce, Shopify, and Squarespace.

PayPal Cons

- High expense: PayPal is now more expensive than Stripe and other payment processing options, especially after increasing its processing fees for U.S. merchants in August 2021.

- Chargeback fees: If a cardholder disputes a transaction, you’ll be charged a $20 fee, unless the transaction is covered by PayPal’s seller protection program.

- Suspended user accounts: If you process too many fraudulent transactions or fail to pay fees, you may not be able to process payments.

- Limited personalization: While easy to set up, PayPal cannot be customized to fit specific business needs.

- Limited payment methods: While PayPal accepts a range of payment methods, some major methods such as Apple Pay, are not accepted.

Final thoughts

Stripe vs PayPal, the two giants of payment processing, each have their own strengths to cater to different business needs. If you’re a small business owner just dipping your toes into online payments, PayPal might be your best bet. It’s easy to set up, free from start-up fees and contracts, and widely recognized, making your customers feel secure when they buy from you.

On the other hand, if your business is more mature and you’re keen on customizing your checkout experience to match your brand (and you’ve got the developer chops), then Stripe is the way to go. It may have narrowly outperformed PayPal in user-friendliness, customer support, simpler fees, and integrations, but both platforms have a lot to offer.

Ultimately, the choice between Stripe and PayPal depends on your business type and needs. PayPal is often the go-to for freelancers, solopreneurs, small business owners, e-commerce stores, and nonprofits. Meanwhile, Stripe excels in online marketplaces, subscription businesses, tech startups, and large enterprises.

So, take a step back and weigh the pros and cons of your specific situation. You may even find that a combo of both payment gateways is the winning formula for your business. The choice is in your hands—make it count!

FAQs

Which is better for small businesses, Stripe or PayPal?

Both Stripe and PayPal offer features and services tailored to small businesses. The choice between the two depends on your specific business needs and preferences.

If you require extensive third-party integrations, customization, and subscription management, Stripe might be a better option.

However, if your business handles a high volume of micropayments or you prefer a more recognizable brand with a broader global reach, PayPal might be more suitable.

Can I use both Stripe and PayPal on my website?

Yes, you can use both Stripe and PayPal on your website to offer customers more payment options. Many e-commerce platforms and website builders support integrations with both payment processors, allowing you to accept payments through both services simultaneously.

Which is more secure, Stripe or PayPal?

Both Stripe and PayPal prioritize security and adhere to the highest industry standards. Stripe and PayPal are both PCI DSS (Payment Card Industry Data Security Standard) compliant, ensuring that customer payment information is securely stored, processed, and transmitted. Both companies offer advanced fraud prevention tools and encryption to protect sensitive data, making them secure choices for businesses looking to accept online payments.

How quickly can I access funds from Stripe and PayPal transactions?

Stripe’s standard payout schedule is two business days for US-based businesses and 7 days for businesses in other countries. However, Stripe offers an Instant Payout feature for an additional 1% fee, allowing eligible businesses to access their funds within minutes.

PayPal funds are typically available in your PayPal account immediately after a transaction is completed. To transfer the funds to your bank account, it may take 1-2 business days for standard withdrawals and a few minutes for instant transfers (additional fees apply for instant transfers).

Is it easy to switch from one payment processor to another?

Switching between payment processors can be relatively straightforward, especially if your website or e-commerce platform supports integrations with both Stripe and PayPal. You may need to update your website’s checkout process, adjust settings in your e-commerce platform, and configure the new payment processor to ensure a seamless transition.

How do Stripe and PayPal handle refunds?

Stripe allows businesses to issue full or partial refunds to customers. The original transaction fees are not returned to the merchant, and there are no additional fees for processing a refund.

PayPal also allows businesses to issue full or partial refunds. For refunds issued within 180 days of the original transaction, PayPal will return the variable portion of the transaction fee (percentage-based), but the fixed fee portion is not returned. There are no additional fees for processing a refund through PayPal.

Stripe vs PayPal: Which Payment Processor is Better in 2023?